Make your accounting close a reliable, automated process

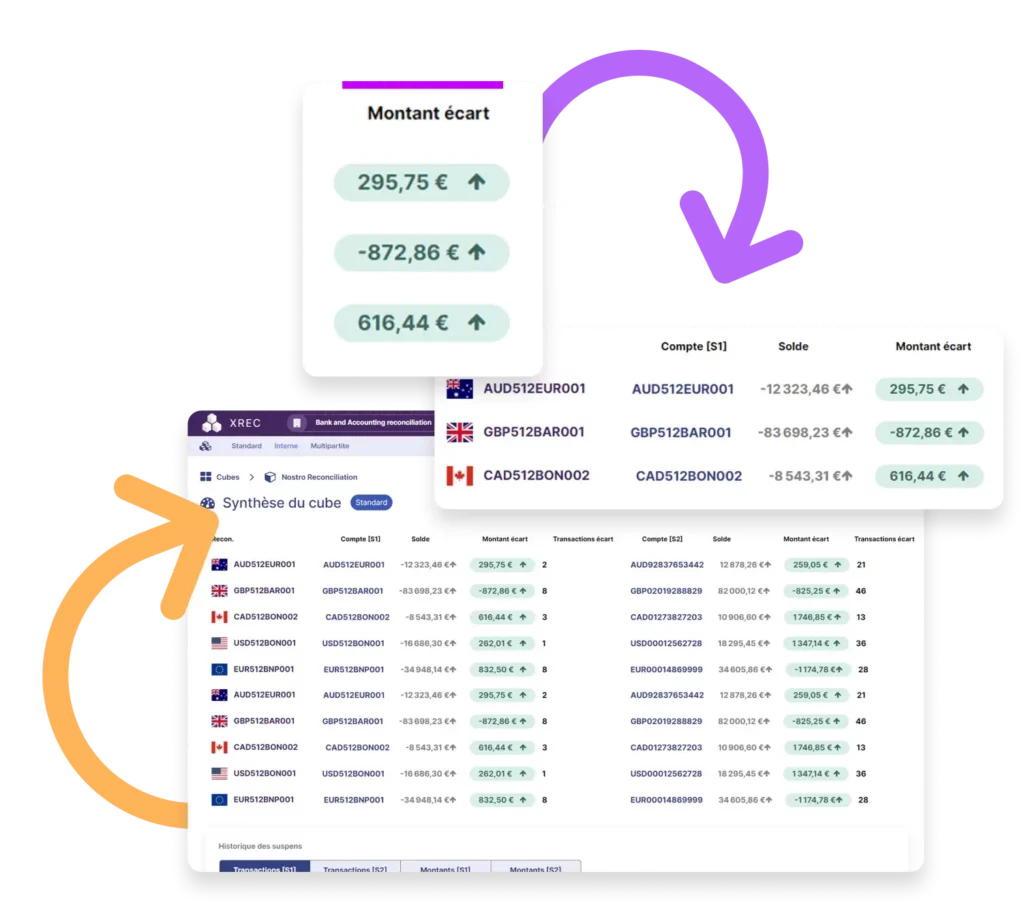

Optimize your accounting close with a centralized and automatedsolution

Gain peace of mind when closing your accounts

Every closing period comes with tight deadlines, multiple validations, and increased pressure on accounting teams. Data fragmentation and lack of standardization slow down the process, increasing the risk of errors and last-minute corrections.

Automating and standardizing financial workflows helps structure and streamline the closing process, providing real-time visibility on accounts and necessary adjustments.

An optimized approach reduces workload at period-end, minimizes stress for teams, and ensures more reliable financial statements. By adopting an efficient methodology, financial closing can become a smooth and predictable process.

Accounting close challenges

Financial close is often stressful, time-consuming, and prone to errors…

Your daily challenges

Customised solutions

Collecting dispersed data :

Lost transactions, supporting documents, non-existent invoices: dispersing data in different systems slows down your accounts closing enormously.

Centralisation :

Centralise financial and accounting data so you don’t have to waste time searching in different systems or asking different people for information.

Harmonising entries :

Entries in different systems also complicate the standardisation of data and increase the time needed to close the accounts.

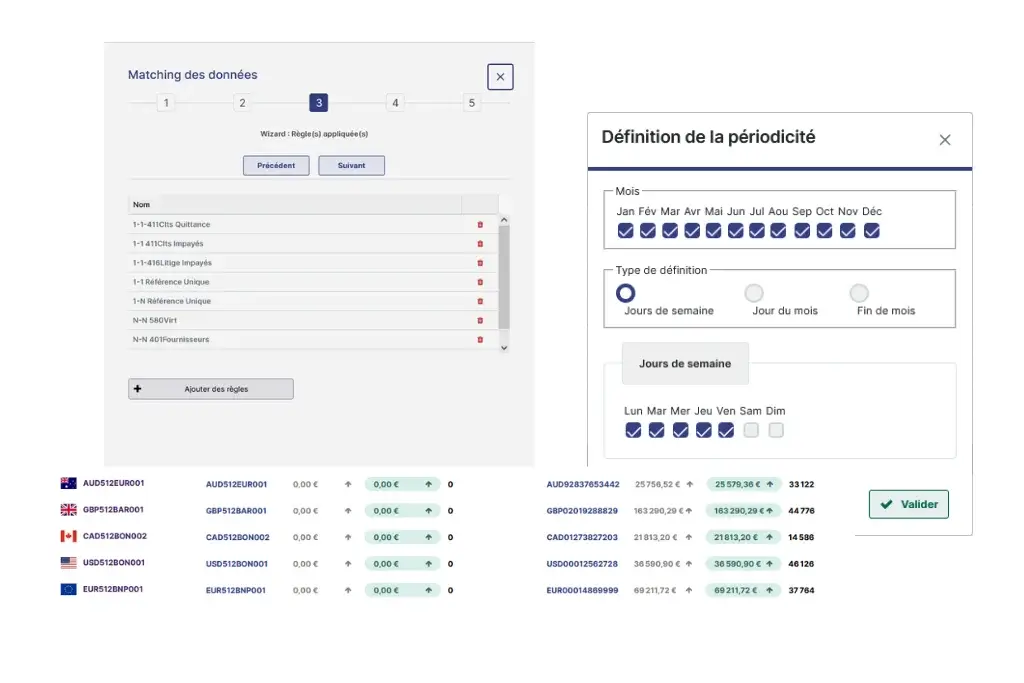

Standardisation & transformation :

Customisation rules to reconcile all entries from different data sources

Risk of human error :

data entry errors, duplications, omissions – manual processing is not only time-consuming, it is also prone to human error, which increases the risk of inaccuracy.

Data accuracy :

Powerful, accurate algorithm with an error rate of less than 1%. Automated tasks reduce human error and speed up closing times with enhanced accuracy.

Deadline stress :

legal deadlines, missed deadlines and penalties, team overtime. The time factor becomes a constraint, and you have to be more efficient.

Always ready for an audit :

Customisable justification frequency (monthly, quarterly, etc.) to ensure compliance BEFORE the deadline.

Regulatory developments :

Constantly changing regulations mean we have to adapt, correct and audit…

Full traceability :

full historical record and dedicated audit trail for easy auditing, so you can go back and trace the life cycle of your financial statements !

Why choose an accounting close optimization tool?

Stay compliant with ease

Minimize risks of errors or compliance failures with a complete audit trail of actions within the solution. Fraud detection and decision – making are facilitated through detailed traceability and period–over– period comparison tools.

Say goodbye to spreadsheets

Centralize and secure your financial data on a robust platform to avoid

human errors and eliminate repetitive tasks.

Automate and standardize workflows

Streamline the justification of third–party, suspense, treasury, and fixed asset accounts, allowing your team to focus on high–value tasks.

Achieve rapid ROI

Benefit from seamless integration with existing systems, user–friendly tools, and significantly reduced accounting close times,

ensuring immediate returns on investment.

Enable efficient collaboration

Assign roles like submitter, approver, and validator to enhance collaboration and improve the reliability of your control processes.

Gain full visibility and anticipate better

Improve your view of financial statements before the annual close. Customize account justification frequency (monthly,quarterly, etc.) and access a fully centralized and historicized database for proactive management.

Discover how XCERT transforms accounting close processes

of data secured

reduction in accounting close time

fewer accounts requiring reconciliatione

They trust us

XCERT provides all our subsidiaries with a single, robust, and effective platform for documenting reconciliations of over 1,500 bankaccounts. Its deployment across the 140 countries we operate in has strengthened our controls and improved the speed of ouranalyses.

François Chabas

EVP CFO, Bureau Veritas

Simplify and accelerate your accounting close with automation experts