PSP reconciliation

Streamline, centralize and automate the reconciliation of transactions from your various PSPs (payment service providers)

All formats, all sources, all currencies

As an e-commerce merchant, managing financial flows with multiple payment service providers (PSPs) is a major challenge. Every day, you may process large volumes of transactions from multiple platforms, currencies, and payment methods. This complexity can lead to reconciliation errors, unresolved discrepancies, and limited visibility into real-time financial flows, which hinders cash management and can lead to costly disputes.

Integrating the XREC platform improves reconciliation accuracy, optimizes cash flow, and ensures increased compliance, while reducing operational costs. This gives merchants greater transparency and control over their financial flows, ensuring more efficient and reliable transaction management.

A flexible, high-performance solution

The XREC solution has been designed for total flexibility of configuration and parameterization (data input and output formats, matching rules, processing orchestrator, automatic gap management, dashboard, consultation screen, etc.). XREC adapts exactly to your needs, not the other way around.

Its simple organizational concept makes it easy to add new sources or new PSPs, and gives you a precise overview of all your transactions.

Automated identification of discrepancies

Give yourself the means to save time and increase productivity. The XREC solution, with its exception management module, automatically identifies and classifies discrepancies by type, according to your criteria. You’ll automatically obtain a highly accurate view of discrepancies and be able to initiate resolution workflows.

Multi-party reconciliation

Synchronize multi-source reconciliations from end to end with our multi-party reconciliation technology. Whichever configuration you choose, you can determine pivot sources with multi-directional transaction matching.

You can perform tripartite reconciliations such as: BO (backoffice transaction log) vs PSP (transaction log) vs Bank (global remittance), quadripartite, etc …

Risk management & fraud detection

Fraud detection and risk management are central to your operations. Detecting anomalies during reconciliation allows you to isolate suspicious transactions and mitigate fraud risks.

International & multicurrency

Online transactions are inherently international. Multicurrency reconciliation is supported, enabling you to load exchange rates directly to ensure accurate currency conversions and prevent overpayments.

Explore all the features of XREC

All reconciliation types

They trust us

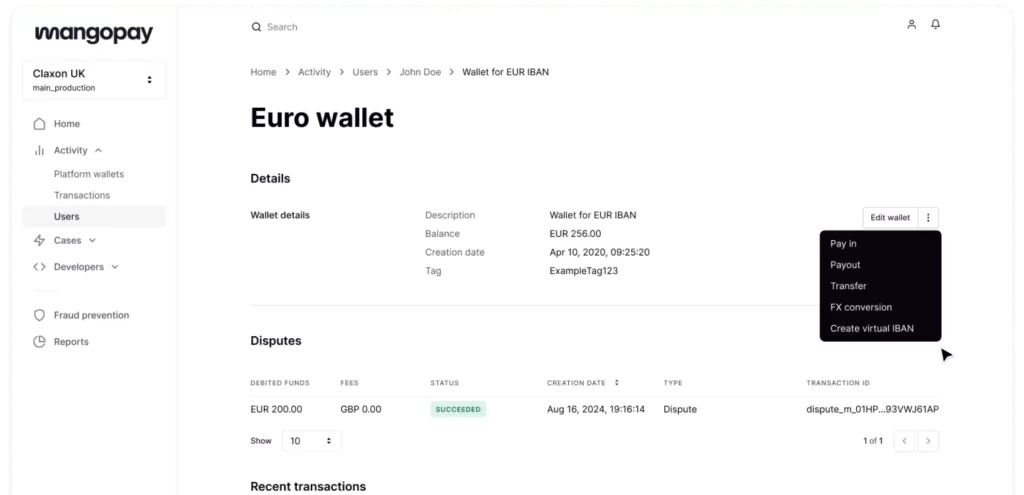

“XREC’s flexibility, rapid implementation of functional needs, and active listening by CALIXYS teams make XREC an essential tool for ensuring optimal control and monitoring of MANGOPAY’s transactional flows, but also supporting the significant growth of the company and the flows under management.“

Finance team

MANGOPAY