Financial markets reconciliation : speed, realiability, compliance

With XREC, you unify your securities and cash flows, automate reconciliations and drastically reduce your exposure to breaks, penalties or non-compliance. Multi-asset, multi-entity, multi-currency: every movement is traced, matched and justified — from the initial trade to final posting.

Perform in an environment of risks and constraints

Improve operational efficiency and reduce your market risks

In financial markets, every second counts. Institutions must process massive volumes of transactions while respecting ever-shorter settlement deadlines (T+1, or even T+0). To this operational requirement are added strict regulatory constraints with interday resolution deadlines to avoid penalties imposed by multiple standards (MiFID II, EMIR, SFTR, Basel III, CSDR — Settlement Discipline Regime) and fragmented IT environments.

Accelerate processing of massive volumes

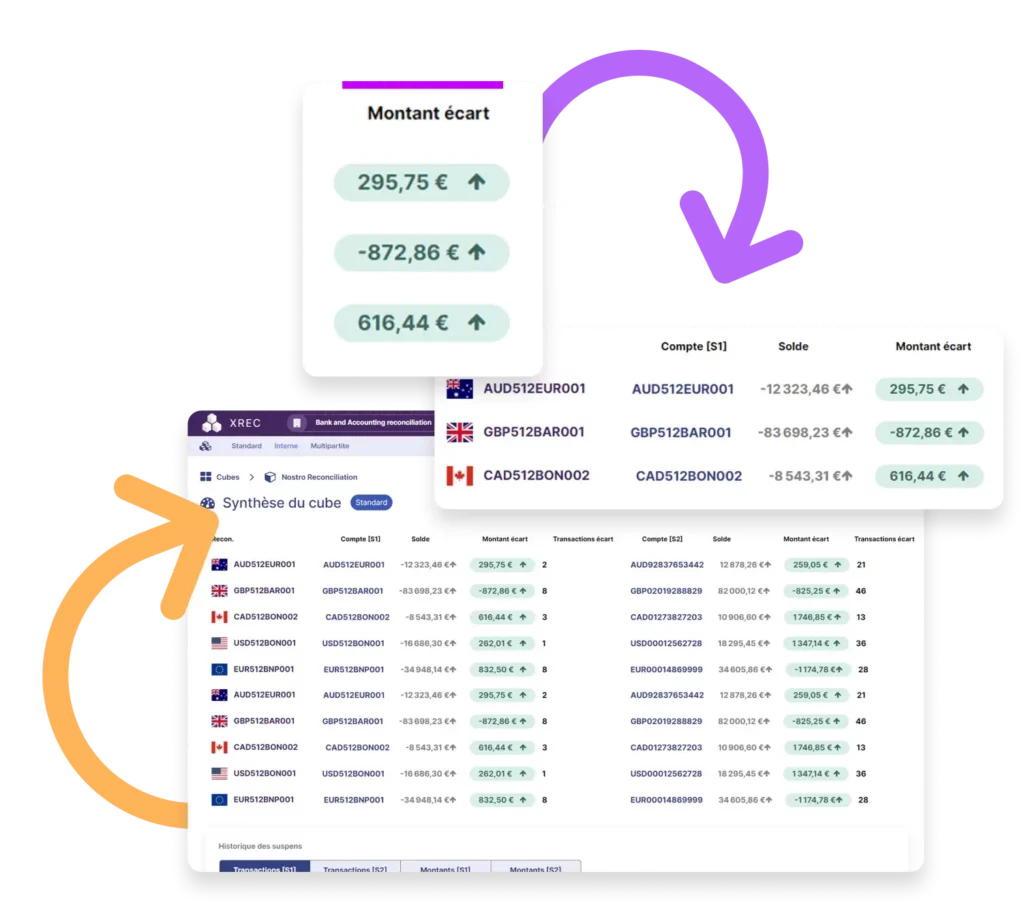

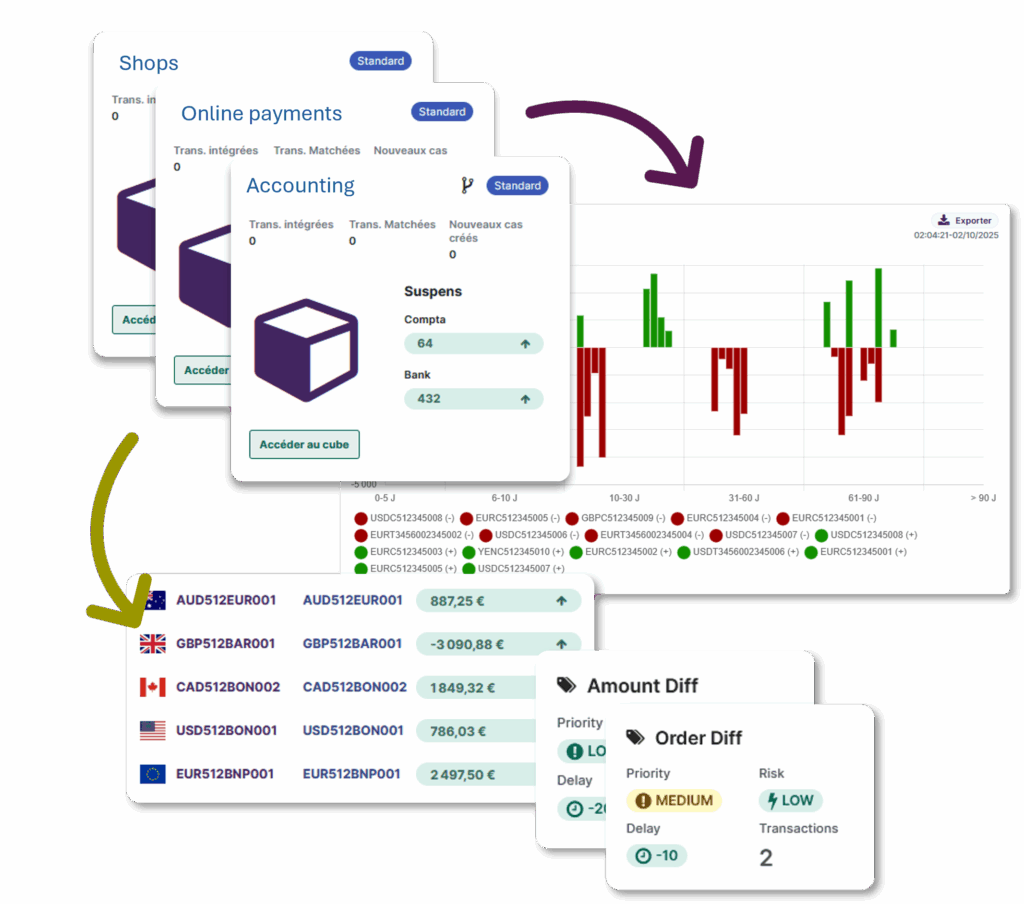

You handle millions of transactions (orders, delivery-settlements, cash movements). XREC automates reconciliation regardless of the source (custodian, counterparty, clearing house) and immediately flags anomalies for early handling.

Limit regulatory penalties

Settlement delays, duplicates and anomalies can be costly. XREC quickly identifies root causes (systemic errors, partial matching, lack of confirmation) and triggers targeted alerts to reduce penalties and avoid market incidents.

Manage the complexity of cross-border operations

Cross-border transactions or multi-currency trades increase the risk of breaks (FX, fees, differing settlement windows). XREC incorporates these parameters to ensure precise matching whatever the market or currency.

Ensure compliance and auditability

Every transaction must be provable and reconstructible in full (complete trade lifecycle): execution, settlement, corporate actions (OST), margins, cash movements. With XREC you have a complete, timestamped history ready to present to auditors and regulators at any time.

Remove the complexity of financial markets

A comprehensive, customizable and robust platform for your specific use cases

End-to-end multi-asset reconciliation

Equities, bonds, derivatives, structured products, FX, securities lending/borrowing: XREC tracks every transaction from the initial order to accounting posting, including all intermediate events.

Leverage transactional granularity

Unique identifier, precise timestamp, origin system, counterparty: every piece of the transaction is preserved to facilitate fast dispute resolution and to demonstrate compliance.

Multi-systems integration and normalization

PMS, back-office, custodians, clearing houses, risk management, accounting: XREC collects and normalizes data from all your environments, supporting standard formats (SWIFT MT/MX, ISO 20022, FIX) as well as proprietary feeds.

Advanced corporate actions (CA) handling

Dividends, splits, mergers, issuances: corporate actions are incorporated into reconciliations to prevent post-settlement breaks and ensure an accurate view of positions.

XREC for all your financial reconciliation types

Expert support for your most complex challenges

From our market experts to your back-office and compliance teams

Objective: fast deployment, smooth adoption and measurable ROI from the first cycles.

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Ready ? Discover our solutions in 10 minutes !