PSP Reconciliation – What is the major challenge of PSP Reconciliation ?

Publié

Le 14/02/2025, par :

- Tony Benedetti

Sections

Context

Nowadays, consumers and companies are pursuing a seamless purchasing journey, including various payment options. However, with more payment options, verifying the transactions between different payment service providers, banks, and your accounting record can get more complicated.

This article will walk you through the PSP Reconciliation process and present the significant challenges most accountants and controllers face.

What is PSP Reconciliation? How does PSP Reconciliation work ?

PSP Reconciliation is an accounting process that compare account balances and different settlement from payment service provider entities to ensure all transactions are true and well-recorded. By doing regular PSP Reconciliation can help the business avoid the payment fraud timely.

Businesses can reconcile the transaction on a regular basis. In most of time, we suggest organizations, especially, that handle high volume of transactions via several PSP every day, should perform a PSP reconciliation as frequent as possible.

It sounds quite simple from the definition; however, the process of PSP reconciliation is getting more complex with the sheer volume and different payment methods, service terms, currencies, even timeframe can vary greatly between service providers.

Accounting professional can perform a PSP Reconciliation in various methods according to the natural of the business setting – One-way, two-way, or multi-parties PSP Reconciliation.

The major challenges of PSP Reconciliation ?

The higher customer expectations, the more complex service the business needs to build. A seamless buying journey and exhausted back-office support are often two sides of the same coin.

So what is the challenge and potential solution for these questions? In this part, we will explain two major obstacles to PSP Reconciliation that most F&A Teams are facing now.

Lack of flexibility and scalability

According to a recent report from Statista, e-commerce businesses will take over 20.4% of global retail sales by the year 2022. Therefore, the process of PSP Reconciliation can get more challenging due to the volume of transactions and various factors.

Efficiently process and control all incoming and outgoing payments and transactional data between your back-office, banks, marketplaces and payment service providers on a single interface.

Although we have already entered a new digital era, and we have seen companies starting the transition toward digitalisation, it is still not fast enough to catch up with the market’s growth.

It is common for company to execute low-volume reconciliation with spreadsheets. However, this manual approach is time-consumed and filled with repetitive tasks. The quality of the outcome is neither reliable.

Enterprises are mostly dependent on their legacy system, which is obsolete and inflexible to absorb a high volume of data suddenly. The legacy system is a bottleneck throughout the transformation process since it is hard to replace yet tricky to integrate with other new systems, moreover, lack of scalability.

It is out of the question that neither spreadsheet nor obsolete legacy system can handle the sheer volume of e-commerce sectors in upcoming years. Without a regular reconciliation, the organisation can face payment fraud or difficulty to have clear view of its own cash flow in a timely manner.

This the reason why companies should start using a solution that is dedicated to completed reconciliation management and designed to adapt to rangy situations at every business growing stage.

Broken workflow for reconciliation process

« We saw many clients starting their PSP reconciliation process by converting the file formats with an extra software to feed the data to the so-called automated reconciliation solution, which from our point of view, is an extremely unnecessary yet risky step. And this is just one of a hundred examples of broken workflow for the reconciliation process. »

– Senior Product Manager at CALIXYS

As you may know, PSP Reconciliation involves a lot of different parts, and it is difficult for F&A Team to fully control the process without the help of dedicated reconciliation solution.

Most accountants have no choice but to separate reconciliation processes into several steps, dramatically increasing the operational risk and creating more repetitive tasks into a tight schedule.

The more additional tools or steps involved, the more difficult for the F&A to monitor and accelerate the operation. With a completed and well-defined workflow, the team can proceed the operation even if the reconciliation structure is complex.

The collaboration between different team members can be smother and optimise the overall productivity of the entire team.

PSP Reconciliation with automation

« Deploying automation throughout the entire reconciliation and controlling process is the game changer for our ecommerce and retailing business. Instead of struggling with manual reconciliation approach, our team now has saved considerable time and react immediately to any abnormal change with reliable data. »

– Controlling Manager at Leading Automobile Device Supplier

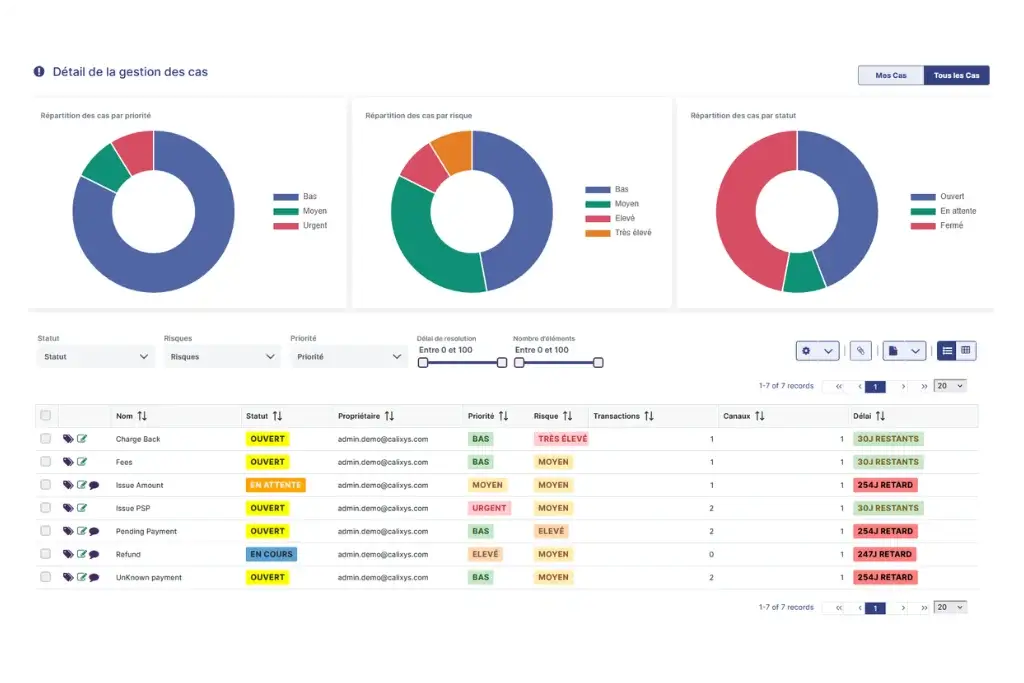

Testimonial from one of our clients. The functionality of XREC solution can easily consolidate and reconcile all transaction data from different data sources at once.

Whether in the e-commerce business or the payment service industry, reconciliation management can only become much more complicated as transaction volumes have continued increasing exponentially.

An automated solution like CALIXYS’ XREC solution addresses all transactional reconciliation and matching issues and allows you to focus on organisational cost, profitability and risk.

It is achieved by fully automating reconciliation and matching, allowing you to quickly detect breaks and discrepancies as soon as the transactional data is available.

Solution XREC for PSP Reconciliation - A key asset for peace of mind

From centralising all retrieval to matching different types of transactions across accounts and systems to exporting accurate and reliable results to your ERP or business units, a powerful all-in-one reconciliation solution like XREC from CALIXYS can handle the entire operation without help from additional applications.

Each Organisation has its unique approach for break management. With advanced algorithms, our comprehensive reconciliation solution can help the accounting professional to create an end-to-end PSP reconciliation process according to business needs. It minimises the risk without limiting the customisable configuration.

« Our F&A; team must handle millions of pay-in and pay-out transactions between our own PSP system, various banks, and entities every month. It sounds exhausting, but the XREC Reconciliation Solution made the entire process easier without sacrificing security and flexibility. With the complete automation of this powerful solution, we can support our company’s rapid growth worldwide.»

– CFO at MANGOPAY

Testimonial from one of our clients. XREC Solution is designed to receives, manipulates, and processes vast volumes of transactions and accounts, across different marketplaces in multiple geographical zones.

Our world-leading multi-parties module allows businesses to process financial data with a well-defined workflow without missing auditable actions.

The entire process can start by gathering transactions from the merchant website or payment system directly, our solution collects the data from the bank and then verify the data between two to three different channels on a single interface.

An end-to-end process automates the operation and can seamlessly integrate into any ERP system. The result of settlement files or reconciliation reports can be exploited quickly by other business teams. It is fully scalable and highly flexible to overcome any complex challenge and adapt to any business circumstance.

Are you still struggling to reconcile various payment service providers, banks, and your own bookkeeping records? It is time to bring your reconciliation to the next step with XREC reconciliation.