Managing Returns, Refunds, and Chargebacks: Tackling Financial Challenges After Activity Peaks

Publié

Le 19/12/2024, par :

- Anne Marie Diom

Sections

Contexte

The holiday season and winter sales represent a pivotal period for e-commerce businesses, retailers, and payment service providers (PSPs). However, after the frenzy of sales, another reality sets in: the surge in returns and disputes. These situations, though predictable, can prove costly and demand rigorous financial management.

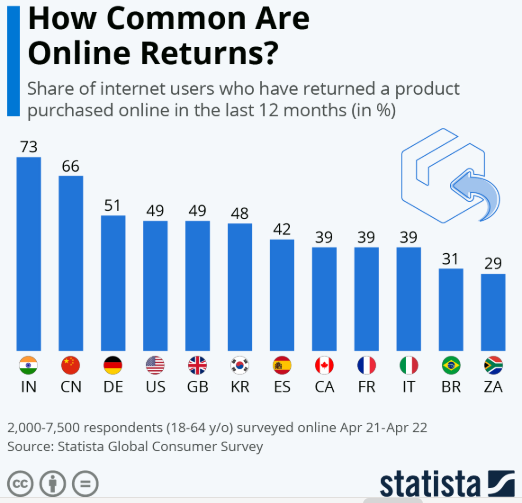

In the United States in 2021, 39% of online shoppers returned items (source: Mondial Relay), with peak activity recorded in January. This trend has only grown over the years; in 2023, 44% of online shoppers (source: Statista) returned at least one product. On top of this, refunds and chargebacks present major challenges in transaction reconciliation and financial management for e-commerce businesses. How can these complexities be anticipated and managed? This article explores the challenges and potential solutions.

The Hidden Side of Activity Peaks: Returns and Disputes

The Hidden Costs of Returns

Massive returns generate logistical expenses (transportation and inventory management), time losses for teams, and an increase in chargebacks. When examining the complete cycle of a return, additional costs for the e-commerce business arise at nearly every stage.

To better understand the cumulative costs a return can generate, consider this scenario:

An online clothing retailer observed that 60% of returns in January were due to incorrect sizes or color errors. Each return requires administrative and logistical processing,

increasing refund times and impacting customer satisfaction. Along with the added logistical costs and operational expenses, this complicates payment reconciliation operations. A transaction recorded as an inflow in December may appear as an outflow in January, potentially generating another transaction if the customer exchanges the item or requests a refund. One can easily imagine the various reconciliation operations these triggers, the discrepancies to address, the lack of clarity, and the possibility of errors.

This phenomenon of massive returns is a global trend observed across multiple countries:

Causes of Massive Returns and Refunds

The main reasons for large volumes of returns and refunds include order errors (defective products, incorrect sizes), impulsive post-holiday purchases, and misunderstandings of promotional offers during sales. These factors significantly increase the need for payment reconciliation.

For example, during sales periods, limited-time promotions create pressure to buy quickly, leading to buyer remorse and an influx of returns. During the holiday season, gifts that weren’t chosen by the recipient often result in returns—wrong sizes, colors, or items that don’t fit their preferences. Ironically, the logistics company UPS declared January 2nd as “National Returns Day.” In 2022, the carrier handled an average of 1.75 million returned packages per day during this period.

Chargebacks: A Double Blow for E-commerce Businesses

Understanding the Types of Chargebacks

Chargebacks, also known as payment reversals, can be categorized as follows:

- Fraud: This occurs when a customer disputes an unauthorized payment, often following actual credit card fraud. For instance, a malicious individual may use a stolen credit card to make purchases. Once the legitimate cardholder notices the transaction, they contest the payment, resulting in a chargeback.

- Legitimate Disputes: These involve valid reasons for a customer to request a refund. Common examples include undelivered products, items that do not match their descriptions (such as incorrect colors or sizes), or services that were not rendered. In such cases, the chargeback reflects a breakdown in the logistical or commercial chain.

- Technical Errors: These chargebacks result from issues in payment processing, such as duplicate charges, incorrect amounts billed, or failed transactions that still appear on the customer’s bank statement. These errors cause frustration and damage the company’s reputation.

- Consumer Fraud: Also known as “friendly fraud,” this occurs when customers abuse the chargeback system. For example, a customer may claim a refund while keeping the item or assert that an order wasn’t received when it actually was. This practice has seen a significant rise over the past three years, increasing by an average of 18% and accounting for up to 70% of return cases in the U.S. “Friendly fraud” costs e-commerce businesses millions annually, as proving customer dishonesty can often be difficult or expensive.

Consequences of Chargebacks

Chargebacks lead to:

- Direct Financial Costs: These include fees imposed by PSPs and the loss of refunded or returned products. For instance, PayPal charges £14 per chargeback, and Stripe imposes an additional £20 fee per dispute.

- Increased Workload for Administrative and Financial Teams: Handling disputes requires manual adjustments, discrepancy analysis, and resource allocation, diverting attention from higher-value tasks.

- Reduced Clarity, Leading to Errors: Transactions may appear as discrepancies, span multiple months (depending on the return period), or remain in a pending status, complicating reconciliation efforts.

- Impact on Cash Flow: Funds are often tied up during the dispute resolution process.

The cumulative costs of re-delivery, compensation, refunds, and the operational burden on finance and accounting (F&A) teams can significantly affect a company’s bottom line.

Should Free Returns Be Reconsidered?

Some companies are reevaluating free return policies to reduce costs. Charging a nominal fee for returns could discourage abuse and decrease return volumes. However, this approach could also harm brand reputation and customer loyalty, particularly in the highly competitive e-commerce sector.

Other strategies to offset chargeback-related costs include:

- Logistical Optimization: Grouping returns by geographic zones to minimize transportation costs.

- Conditional Return Policies: Offering free returns only for products that meet specific criteria (e.g., pristine condition, returned within a set timeframe).

- Partnerships with Specialized Providers: Collaborating with return management companies to streamline and outsource the process.

- Predictive Technologies: Leveraging analytics tools to identify products with higher return rates and peak return periods, then adjusting descriptions or quality processes accordingly.

When combined with automated financial reconciliation, these solutions can help e-commerce businesses and retailers absorb costs while maintaining a positive customer experience.

Preventing and Effectively Managing Returns in Financial Flows

Automating Returns and Refund Processing

Automating the financial reconciliation process can significantly reduce the costs and challenges associated with chargebacks. Automation not only saves substantial time compared to manual tasks but also ensures accurate tracking of all inflows and outflows. This approach allows companies to identify anomalies before they escalate into disputes.

Quickly Detecting Fraud

Regular, real-time monitoring helps prevent or mitigate significant losses. Tools that isolate transactions with discrepancies enable closer scrutiny of anomalies, faster detection of suspicious transactions, and a shift in financial teams’ focus from manual reconciliation to analysis and resolution.

Prioritizing Real-Time Processing

Real-time transaction reconciliation is crucial for maintaining smooth operations. This includes automatic payment updates and clear financial reporting to anticipate potential issues.

Companies offering automated reconciliation solutions have reported a 25% reduction in chargeback-related disputes.

Conclusion

For e-commerce businesses and retailers, managing returns and chargebacks is a priority after peak activity periods. Effective financial reconciliation relies on automation, proactive anomaly detection, and real-time analysis. These approaches not only reduce costs but also enhance customer satisfaction, ensuring greater financial sustainability.

Discover how XREC can automate your payment reconciliation processes with precision, helping you track every discrepancy and chargeback effectively.