Transform your processes to improve them

Traditional accounting and financial systems struggle to keep up with digitalization and evolving regulatory requirements.

Dependence on manual processes slows down operations, increases errors, and limits business scalability. Adopting modern, interconnected tools helps automate, secure, and streamline financial workflows.

Digitalization also enhances collaboration between teams and enables faster decision-making with real-time, reliable data. Transitioning to a digital finance model means gaining agility, security, and performance.

Striving for performance

I aim to transform the finance department to make it more efficient and profitable

Your daily challenges

Customised solutions

Accounting errors :

Discrepancies between payments received and invoices issued, manual entries prone to errors.

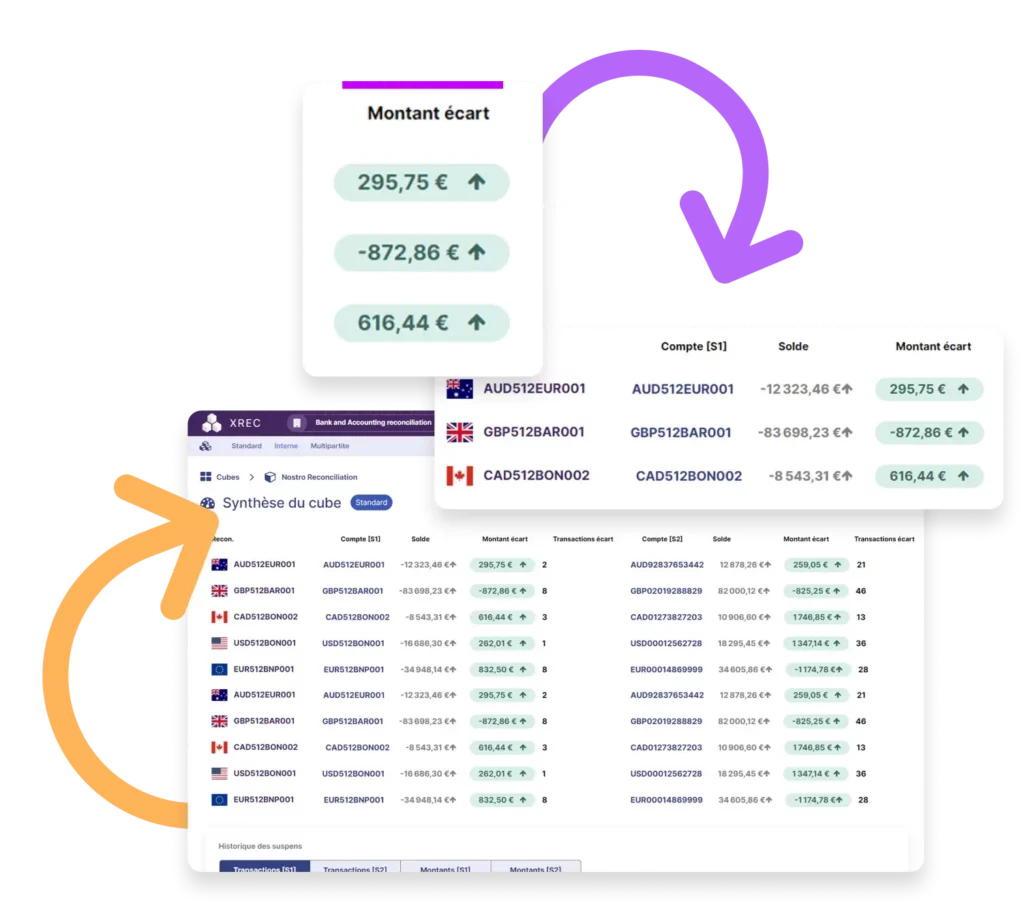

Automated flow reconciliation :

For immediate detection of discrepancies and simplified correction.

Slow, time-consuming processes : manual reconciliation of transactions, multiple Excel files to analyse.

Data centralisation :

and real-time processing for fast, fluid management of financial flows.

Lack of visibility of transactions :

difficulty in tracking payments, refunds and disputes.

Dashboard :

in real time with detailed monitoring and clear reports for rapid decision-making.

Fraud and non-compliance risks :

undetected errors, risk of tax reassessments, complex audits.

Automated controls :

to ensure compliance with standards and secure your financial transactions.

Non-optimised discrepancy management :

Late correction of anomalies, impact on cash flow and closing of accounts.

Intelligent deviation management tool :

With automatic alerts and suggested corrections.

Discover the concrete steps for implementing the solution

Average implementation time

Customer satisfaction rate

Hours saved annually

Advantages of a complete modular suite

Encryption & Hosting

High-level encryption standards. All sent or received files can be encrypted usingmarket-standard protocols (AES 128/256). Highly sensitive information can beencrypted directly within database tables.

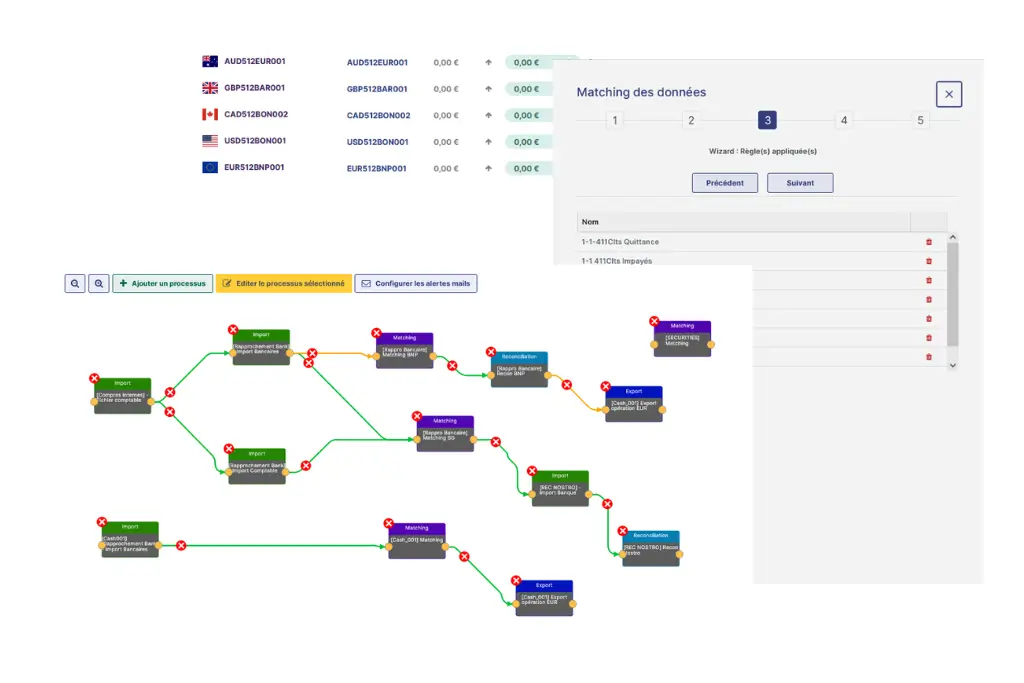

Transformation & Digitization

Free finance teams from manual, time-consuming tasks. Their time is now focused onhigh-value activities such as analyzing discrepancies, ensuring compliance, anddelivering reliable reporting.

Ease of Use

The platform is user-oriented and designed for finance professionals. It’s intuitive,clear, and fully documented (user guides, import documentation, etc.). OurProfessional Services team supports implementation, integration, and training toensure a smooth adoption process.

Say goodbye to disparate tools

A complete end-to-end solution for managing reconciliation and accounting close. Allfinancial data for these operations is centralized on a single platform, from import toexport (record-to-report), eliminating the need for multiple disparate tools.

Expert Solutions

Designed by experts for experts, Calixys solutions are adaptable to every industry,capable of managing all types of reconciliation, data formats, and sources. Businessrules are fully customizable, and personalization options are limitless (data mapping,categorization, identification rules, exceptions, tolerance settings, dashboards, etc.).

Ready ? Discover our toolsl in 10 minutes !