All your financial reconciliation processes in one place

Automate your end-to-end financial reconciliation processes

Optimize your financial reconciliation processes

Managing growing transaction volumes while ensuring accurate reconciliation is a major challenge.

Data is often fragmented across multiple systems, making the matching process complex and time-consuming. Automating reconciliation drastically reduces errors, enhances financial accuracy, and improves transaction traceability.

By structuring and centralizing data from the outset, discrepancies can be detected more easily, ensuring effective control over transactions. This approach provides a clear and precise financial overview, essential for informed decision-making.

Precision, flexibility & performance

“I need to reconcile a high volume of transactions accurately and efficiently, but it’s challenging because…“

Your daily challenges

Customised solutions

Scattered & disparate data :

Your teams are wasting time looking for the right information, the right transaction, the right receipt across different systems and contacts.

Data centralisation & standardisation :

All your reconciliation data in one place. All your formats and sources are standardised.

Large volumes of data :

You need to cope with a growing and fluctuating volume of data while maintaining the same level of accuracy and productivity.

Powerful algorithm :

Powerful and robust, our algorithm reconciles millions of transactions in record time. It is also flexible, adapting to fluctuations in volumes without requiring operational changes.

Handle different types of reconciliation :

Reconciliation of payments, accounts, PSP cash, bank cards, etc. Depending on your sector of activity, the types of reconciliation vary and require an expert tool.

Adaptability & customisation :

Matching & tolerance rules can be configured to suit the specific needs of each company, XREC performs all types of financial and non-financial reconciliations.

A complex, multi-player process :

Reconciliation processes are crucial and require permanent, comprehensive control involving several employees, all of whom must have the same clear, accessible and reliable information.

Designed for efficient collaboration :

Differentiated roles and granularity of rights according to connection profiles. Assignment of control chain roles (submitter, approver, validator, etc.).

time saved in matching

matching rate

reliable data

The key advantages of an automated reconciliation tool

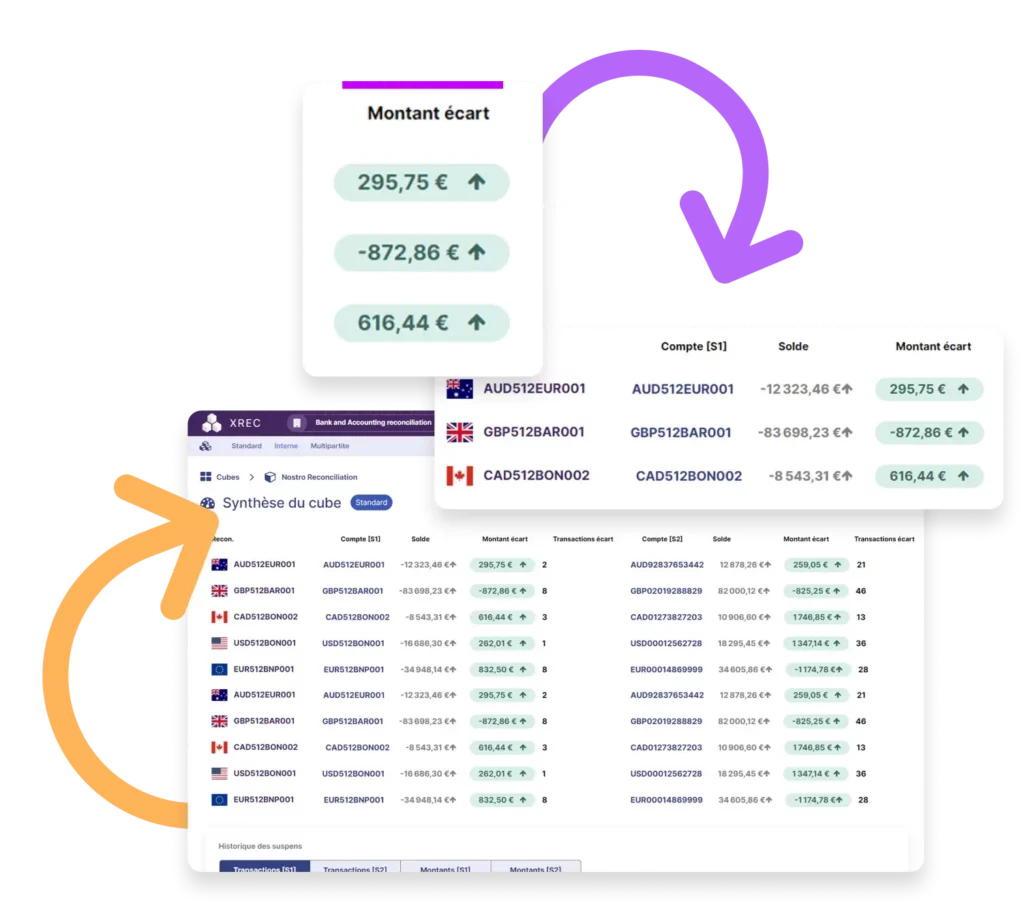

All your reconciliations in one place

Centralize data from various sources and perform all types of financial reconciliations. The entire processing chain—collection, matching, discrepancy identification, classification, and resolution is handled within a single platform.

Customize and optimize for greater efficiency

Personalize discrepancyidentification and classification rules, set priorities, deadlines, and assignresponsibilities.

Power and precision

Reconcile millions of transactions in seconds with a99.9% matching rate.

Simplify, automate, and secure your reconciliations

They trust us

“CALIXYS provides GENERALI France with its advice and all its expertise on the issues of reconciling financial and accounting data. We have been able to set up the automation of a very large number of data reconciliations.“

Christophe PRIVAT

Manager Commissionnemet, GENERALI

“The power and adaptability of the XREC solution, given the diversity of matching rules we need, makes this tool a central element in monitoring our daily operations.”

Alexis Michard

Head of finance and accounting, Orange Bank

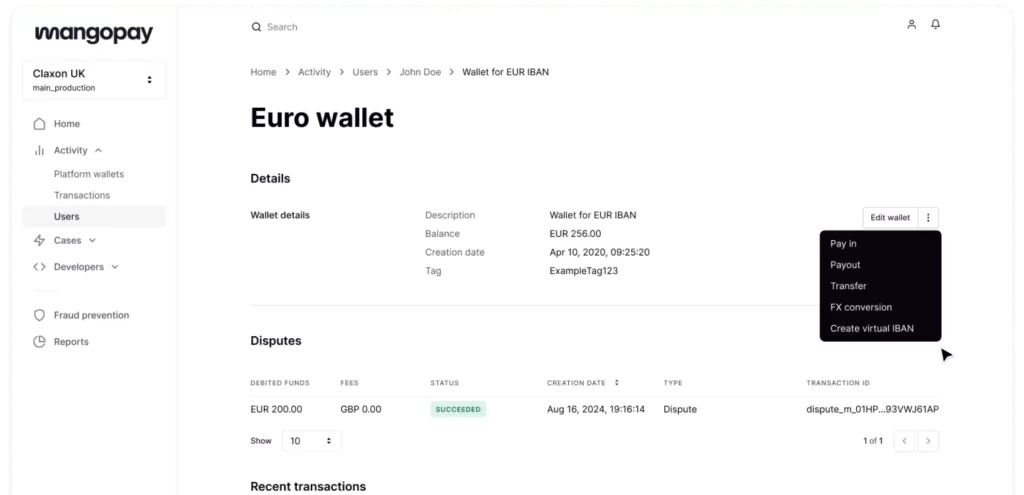

“XREC’s flexibility, rapid implementation of functional needs, and active listening by CALIXYS teams make XREC an essential tool for ensuring optimal control and monitoring of MANGOPAY’s transactional flows, but also supporting the significant growth of the company and the flows under management.“

Finance team

MANGOPAY

Discover how to automate data matching with XREC’s reconciliation platform