Banking : Manage your reconciliation process effeciently

A platform that meets banks’performance and regulatory requirements.

More than ever, banks are under intense regulatory pressure. Increasing transaction volumes are heightening the complexity for downstream, back-office and middle-office teams to process information and ensure accurate control of financial transactions. Regulatory authorities are urging companies to implement strategies for operational resilience, and to strengthen financial governance by adopting control processes that are equal to the challenge.

The ability to access accurate data quickly, whatever the volume, is a major growth challenge, and one that CALIXYS can help you meet.

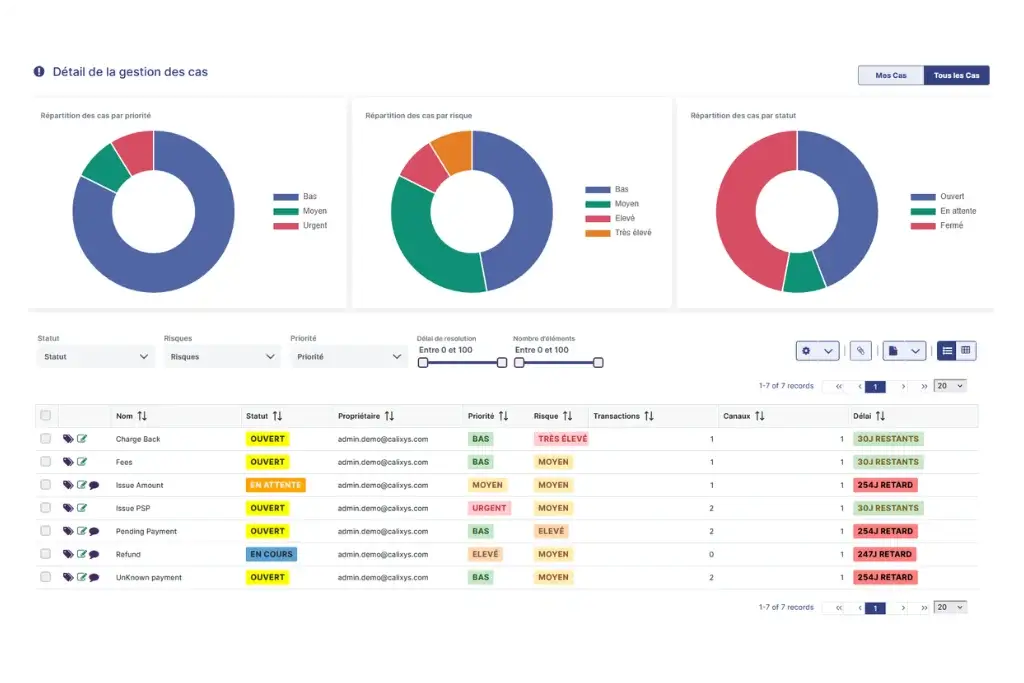

Real-time visibility and control

Thanks to our reconciliation platform, a bank can monitor transactions and financial flows in real time. This enables more proactive cash management, while facilitating decision-making based on accurate, up-to-date information.

Managing discrepencies and reducing exception rates

The XREC reconciliation platform enables discrepancies in transactions to be detected quickly, the causes identified and workflows and alerts set up for rapid resolution. This helps to reduce disputes and avoid the financial penalties associated with unresolved discrepancies.

Improving operational efficiency and reducing costs

By automating reconciliation across all departments, banks can significantly improve their operational efficiency. Fewer resources are required to process and verify transactions, allowing staff to focus on higher value-added activities, such as analysing financial data or improving financial strategy. By reducing errors and delays, the bank can also limit financial losses and litigation costs.

Regulatory compliance & risk management

The automated XREC platform integrates enhanced control processes and generates reliable audit reports, ensuring compliance with current regulatory standards. It also enables operational and financial risks to be managed more effectively.

Automating reconciliation processes and reducing manual errors

Thanks to automation, the XREC platform can quickly and accurately align internal transactions with those of counterparties, eliminating manual input errors and speeding up reconciliation processes. This improves data accuracy and ensures that discrepancies are detected and corrected in real time.

Discover how to improve your end-to-end reconciliation process

Less time spent closing account

Reduce financial losses due to non-justification

Less time spent managing reconciliations

XREC for all your reconciliations

They trust us

“The power and adaptability of theXREC solution, in the face of thediversity of matching rules we need,makes this tool a central element inthe monitoring of our daily operations.“

ALEXIS MICHARD

Head of Permanent Control, OrangeBank

“XREC is a major element in the control tower, enabling us to check that financial transactions are correctly accounted for. We now have automated reconciliation processes that save the business team a considerable amount of time.“

Olivier JEAN & Ronald MOUNIEN

Deputy CEO and Head of IS Finance, NICKEL