Automate reconciliation break management

Publié

Le 19/05/2024, par :

- Anne Marie Diom

Sections

Contexte

Effective management of accounting reconciliation break is crucial to ensure the financial health, regulatory compliance, and reputation of a company. Discrepancies, whether related to non-matching transactions or input errors, can significantly impact an organization’s operations and profitability.

In this article, we will explore the financial risk associated with managing accounting reconciliation break and the benefits of automating this process. Additionally, we will introduce the new version of Calixys’ reconciliation platform, XREC, which offers advanced features to automate the detection, processing, and classification of discrepancies, thereby enhancing the efficiency and accuracy of reconciliation processes.

The financial risk of reconciliation breaks

Break management refers to the process by which financial services reconcile records between external systems (e.g., bank statements) and accounting records. For instance, in bank reconciliations, all recorded transactions at the accounting and bank levels must be compared. If all transactions match in terms of data (amount, date, description, etc.) and are present in both systems, it’s a perfect match.

However, when transactions are missing in one system or the other, or if they don’t match exactly, discrepancies arise.

There are two types of discrepancies:

“False” discrepancies, which are often due to:

- Incorrect configurations in source systems

- Lack of precision in matching rules

- Technical data integration issues

“True” discrepancies, which are often due to the:

- Non-recording of transactions

- Human errors in recording

Once detected, discrepancies must be resolved to ensure account perfect balances. If there is an input or calculation error, it must be corrected, or at the very least, justified in case of an audit.

The second step is to analyze discrepancies. Once automatically detected, they must be isolated, analyzed, and classified. For each discrepancy, it must be determined whether it’s a duplicate, a missing entry, or an orphan, for example, through comparative identification.

Regular and diligent discrepancy management ensures a company’s financial health, its reputation, and also helps detect fraud and process flaws. Moreover, excessive discrepancies often lead to significant financial losses for companies, making it a matter of profitability.

The cost of poor reconciliation break management

While it’s challenging to provide an exact figure for the cost to a company of not managing or managing reconciliation breaks poorly, as it depends on various factors (company size, industry, nature, and extent of discrepancies, etc.), the following elements can be considered:

- Direct Costs: Reconciliation breaks can lead to errors in financial statements, necessitating adjustments and corrections. This can result in direct costs such as additional fees for accountants or auditors to resolve the issues.

- Loss of Time and Productivity: Researching and correcting reconciliation discrepancies can consume a lot of time and distract employees from their primary tasks, leading to productivity losses and delaying other business processes, not to mention missed opportunities for growth or innovation. Resources spent on resolving reconciliation breaks could be used more efficiently elsewhere in the company.

- Loss of Stakeholder Confidence: Significant and repeated discrepancies in accounting reconciliations can erode the confidence of shareholders, investors, creditors, and other stakeholders in the company’s ability to manage its finances effectively and transparently. In other words, this can negatively affect the company’s valuation and reputation in the market.

- Sanctions and Fines: In some cases, significant discrepancies or poor management of accounting reconciliations can result in regulatory sanctions or fines issued by financial regulatory authorities.

Therefore, it is essential for companies to establish robust accounting reconciliation processes to avoid these potential costs. Specific costs will vary from one company to another, but poor management of reconciliation discrepancies can have significant financial repercussions. Based on our experience and depending on the size of the company and its industry, the average annual cost can reach hundreds of thousands of euros. And in the banking sector, this figure can easily be multiplied by 2, 3, or more, depending on whether it’s a private house or a public institution. These financial losses have long been part of an accepted loss tolerance by companies. As of now, and thanks to automation replacing manual verifications, companies can significantly reduce these losses.

Why automate reconciliation breaks detection and processing ?

Automating reconciliation break management offers numerous benefits for companies:

- Time Saving: Automation enables much faster reconciliation processes than manual approaches. This frees up time for employees to focus on higher-value tasks.

- Reduced Human Errors: Manual processes are prone to human errors, such as incorrect data entry or oversight. By automating these processes, companies can significantly reduce the risk of errors and improve the accuracy of their reconciliations.

- Enhanced Compliance: Automation allows for the implementation of automated controls and validations to ensure compliance with accounting and regulatory standards. This reduces the risk of non-compliance and associated consequences, such as fines or penalties.

- Improved Visibility and Traceability: Automated reconciliation break management systems provide better real-time visibility. Companies can easily track and audit transactions, improving traceability and transparency.

- Scalability: Automated reconciliation break management systems are often designed to be scalable, meaning they can easily adapt to company growth and increased transaction volume, as well as regulatory fluctuations.

In summary, automating accounting reconciliation break management allows companies to improve compliance and accuracy while freeing up time and optimizing resource usage.

Automate and resolve reconciliation break management with the new XREC version from Calixys

Calixys is launching a new version of its automated platform, XREC.

XREC is a SaaS solution developed by the Calixys team, aimed at helping companies automate and ensure the reliability of their reconciliations with a powerful and precise algorithm.

In this new version, the Calixys team aimed to further enhance the tool’s performance by being more attentive to user needs and offering even more adaptability. This new version includes:

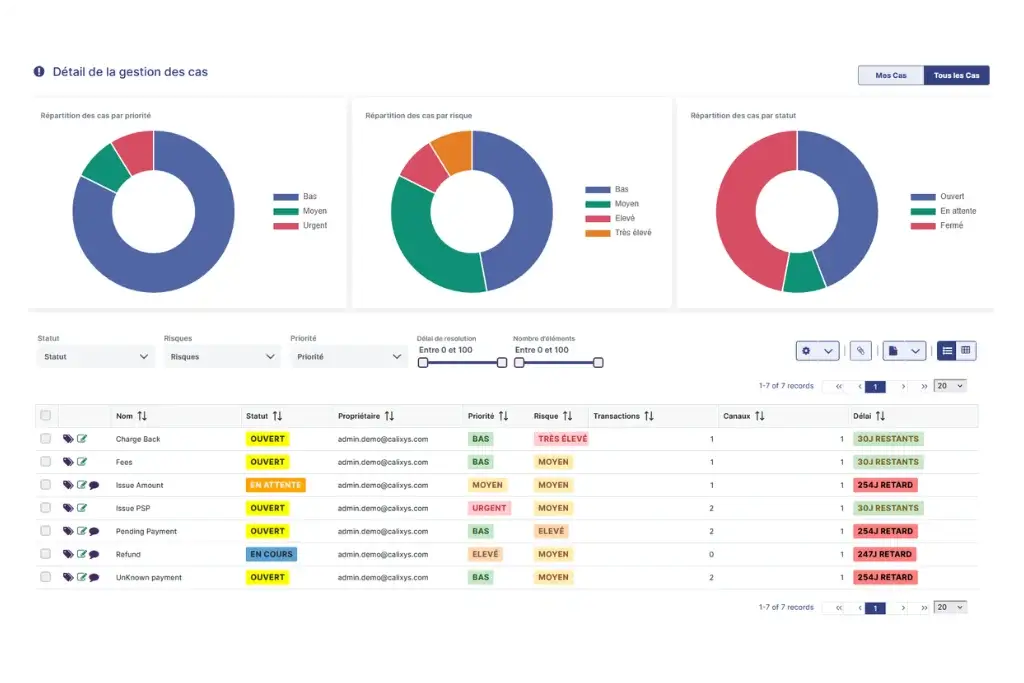

- A new feature of errors and exceptions automatic handling and classification

- A completely redesigned interface and user experience to be even more fluid and intuitive.

- A redesigned overview for more synthetic, efficient, and accessible dashboards.

Errors and exceptions automatic management and classification

Automatically identifying discrepancies rather than doing it manually saves considerable time and efficiency. But with this new XREC version, the Calixys team wanted to go further.

In addition to detecting discrepancies, the solution now allows for automatic handling and classification of exceptions. Once discrepancies are identified, they can be set aside for analysis and classification.

Let’s take the example of a transaction reconciliation:

It is not only possible to know which transactions are not matched and the unique or cumulative amount of these discrepancies, but also to know what type of discrepancy it is thanks to pre-defined exception rules. When a transaction reconciliation presents a discrepancy, it is possible to determine whether it’s an orphan, a duplicate, an error, etc.

How Does it Work ?

Step 1: Create identification rules on the platform to define criteria for each transaction matching.

Step 2: Create exception rules that allow cases outside the identification rule to be set aside.

Step 3: Create exception jobs to qualify and classify anomalies among the exceptions.