Payment reconciliation simple, reliable & efficient

Automate, standardise and simplify all your payment reconciliation processes with a robust and flexible R2R platform

Centralize your multi-source reconciliations

E-commerce is more than ever faced with increasing sales volumes and regulatory pressure. Direct online sales using a variety of payment methods are becoming the norm.

To stay competitive and avoid penalising production, payment recording control must be efficient, reliable, fast and accurate throughout the cycle. It is necessary to correctly account for numerous transactions via different sources and players (back office, banks, marketplaces and PSPs). In this way, stocks and payments are properly controlled and verified. Errors are identified and dealt with more quickly.

The Calixys platform enables you to centralize reconciliations with your various sources : banks, marketplaces, PSPs, acquirers and your accounts. Whatever your B2C orB2B model. Manage very large volumes of data with ease and high performance. Use our multi-way technology for multi-source reconciliations.

With CALIXYS, you can make your financial data more accurate by quickly reconciling your data, quickly detecting errors and ensuring your company’s compliance.

Trusted by leading companies

XREC enables us to reconcile all our tills for all our shops in France. Not only have we been able to automate our discrepancy analysis processes, but we’ve also given our staff complete autonomy to manage their day-to-day activities as efficiently as possible. Thanks to the solution, they are able to process 100% of the data, allowing them to concentrate fully on the really problematic cases of discrepancies.

Emeline DALLE

Product Manager IT Finance, LEROY MERLIN

Discover the advantages for e-commerce & retail sector

Multi-channel & multi-currency consolidation

You receive payments through a multitude of channels (credit cards, e-wallets, bank transfers) and in different currencies. Our centralised platform enables you to consolidate these transactions, providing a unified view that simplifies reconciliation between the various sources.

Automating reconciliations and reducing errors

The Calixys reconciliation platform uses automation to reduce the human errors associated with manual reconciliations. It automatically detects inconsistencies between payments and orders, reducing the costs associated with errors, manual adjustments and undetected discrepancies.

Improved visibility and traceability in real time

The speed and accuracy of transactions are crucial to you, so the Calixys reconciliation platform provides real-time visibility of payments, making it easier to monitor financial flows. Anomalies or discrepancies are identified instantly, enabling proactive management of problems before they affect cash flow.

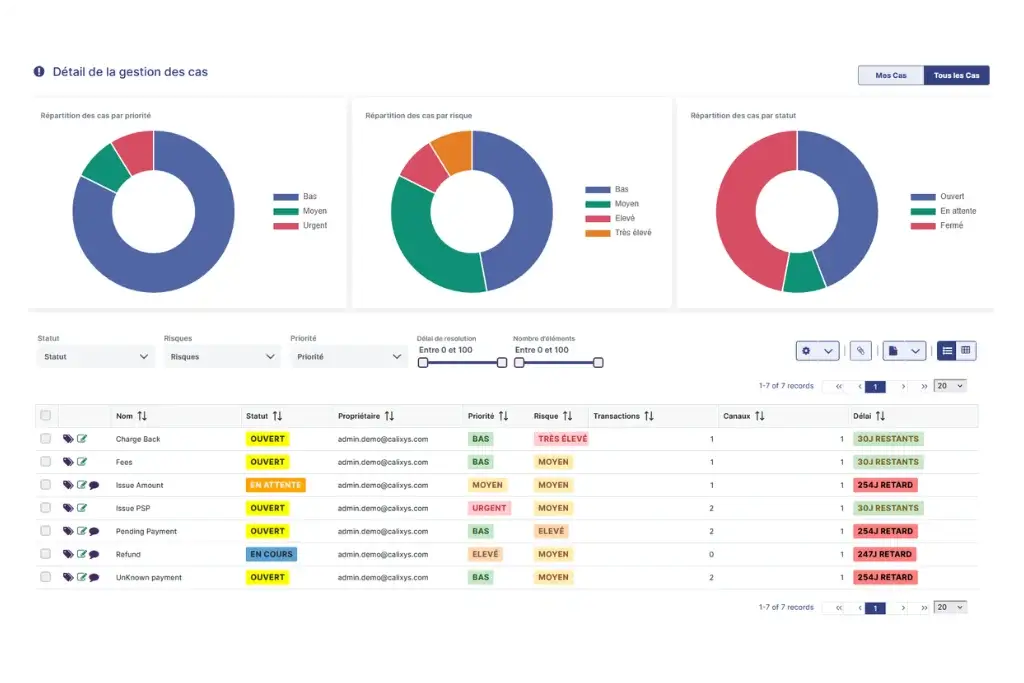

Simplified management of disputes

Payment anomalies and disputes (e.g. refunds, cancellations, billing errors) are commonplace. Thanks to its automated breaks management module, our platform automatically identifies discrepancies and helps to detect and resolve these anomalies more quickly, making it easier to respond to customer complaints.

Enhanced compliance and easier audits

With full transaction traceability and automated reconciliations, our XREC platform makes it easier for you to meet financial and regulatory compliance requirements. In the event of an audit, it provides a clear, documented audit trail, reducing the risk of non-compliance and the costs associated with manual checks.

Discover how to accelerate payment reconciliation

How XREC adpat to E-commerce & Retail

You can reconcile all in-store payments (card, gift voucher, automatic tills, etc.) in a reliable, robust system capable of processing large volumes of data. All the consolidated information is sent back to head office, regardless of the number of shops, the diversity of payment methods or the geographical area.